0 to 1 Crore a Journey to Financial Freedom in Nepal

Do you want to achieve financial freedom free before turning 24? If so, this blog is for you. You must be wondering how you can achieve financial freedom.

Do you want to achieve financial freedom free before turning 24? If so, this blog is for you. You must be wondering how you can achieve financial freedom free in the context of Nepal. Hold your nerves and read this blog freely. I will share some simple and engaging steps to help you reach your goal to achieve financial freedom. If you're a student or gaining skills through work, this blog is for you.

So, what do you think earning Crore is easy or difficult? If you follow these steps you will definitely earn a crore in the coming few years.Earning crore is not difficult, if you strictly follow the discipline guideline for yourself.

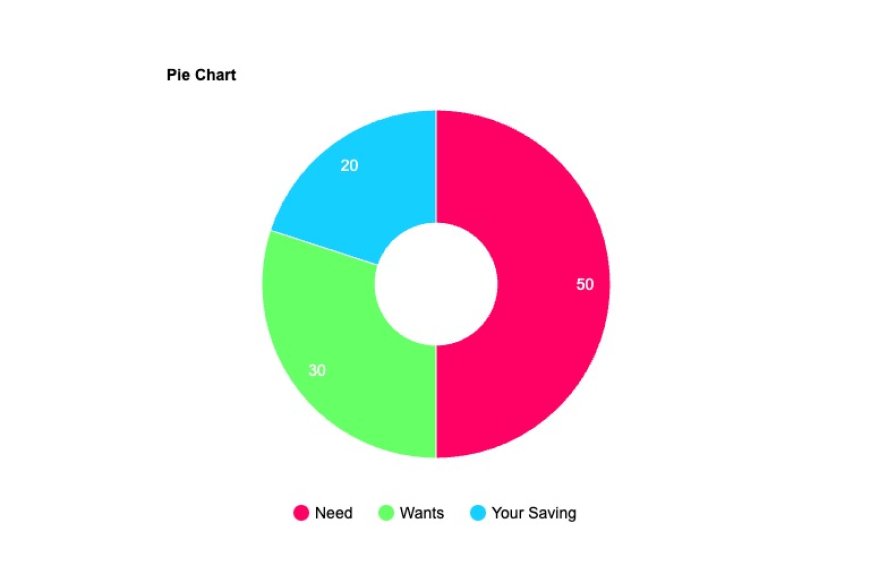

Follow 50, 30, and 20 rule

In the above Diagram you are amazed about these 50, 20, and 30 rules. But this is a discipline road map for your financial freedom. How this rules works, here are the few technique you should follow to free from financial freedom

50 means a 50% from your salary for needs of yours, 30 means a 30% from your salary for your wants and 20 means a 20% from your salary.

Here, you need to identify your Needs, wants and save the remaining money

-

What are your needs, it is your food, cloth, house rent, and others

-

What are your wants, it may be “trek”, “tour”, “watching movie” and others as per your wants

-

What is your platform where you save your money, ig-bank etc.

Let’s understand the 50,30,and 20 rule by an example: Imagine you have a salary of Rs.20,000. Then firstly you need to spend your 20,000 salary on your needs which is 50%, which will exclude 10,000 from your salary. And your remaining money will be 10,000 which you need to exclude for your wants which will be 3000 on your wants and remaining money would be 7000. Then save your remaining money in your respective platform like bank, insurance and others etc.

Invest your money

Investment is another part of your financial freedom. Investment played a huge role in your financial freedom journey. In the context of Nepal, people from a medium range of salary are still suffering to save their money for their future and emergency. Having an understandable financial knowledge will help you achieve financial freedom. There are some platforms where you get a good sum of returns, you may have heard about this platform.

1. Health insurance

Health insurance is a major platform where you should invest your money and get a good return for your health safety. Health should be prioritized first, which we all know that “Health is wealth”. Here let’s take an example

If you take 5 Lakh health insurance for 5 years then your yearly payment will be Rs.3300 (roughly) a year and Rs.275 (roughly) a month. Which is easily saved by any of the student, intern or whosoever is below Twenty thousand salary.

2. Life Insurance

Life Insurance is another financial plan that you need to prioritize for your financial freedom journey. There are various LIfe Insurance Plans but the most preferable plan is “Myadi Jeevan Beema” which is also known as Term life Insurance. Let’s take an example and understand its concept step by step. Let’s say for Life Insurance you have taken a 15 Lakh coverage for 15 years, now your yearly payment would be Rs.2,500 (Around) and monthly Rs.200 (Around). Which can be easily done by everyone.

If we lack extra savings for the monthly premium, we can save about Rs. 3,000 to Rs. 4,000 each month, totaling approximately Rs. 12,000 per year. Our yearly health premium is Rs. 3,300, and our yearly life insurance premium is Rs. 2,500, amounting to Rs. 5,800. This is sufficient for our prioritized investments and financial freedom.

3. Emergency Fund

Emergency Fund is a Crucial element in your financial freedom. It is an unexpected incident that happens any time at any place with anybody.

Emergency incident are

-

Business recession

-

Loss of Job

-

Pandemic

-

Unexpected Expenses

To prepare for emergencies, it's essential to build an emergency fund. Relying on investments for emergencies is a misconception; withdrawing from your investments can derail your path to financial freedom. To learn more about emergency fund, you can learn from here Emergency Fund - Easy Ways to Start Saving for Emergencies

How to create an Emergency Fund

If you are not only the earning member in your home including others your father, mother, and your spouse. Then save your monthly income 3 times for an emergency fund

If you are only the earning member in your home then save 6 times of your monthly income in an emergency fund. Suppose your monthly income is Rs.30,000 then you have to save up to Rs.1,80,000

Invest your Money in Systematic Investment Fund (SIP)

SIP is one of the secure platforms for your long term investment plan. It is a discipline to save your money for your financial freedom.

What SIP provides to you

-

Power of compounding

-

Rupees cost Averaging

-

Discipline financial strategy

-

Investment for specific goal

In a Low risk it will provide you good return for your financial freedom. To learn more about SIP, you can learn from here SIP in Nepal: A Future Financial Growth

Frequently Asked Question (FAQ's)

1. What is the concept of financial freedom?

Haing enough residual income to cover your living expenses

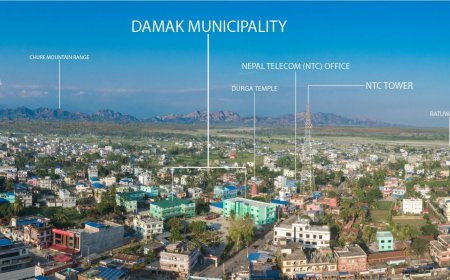

2. What is the economic freedom of Nepal?

Nepal's economic freedom score is 52.1, making its economy the 130th freest in the 2024 Index of Economic Freedom. Its rating has increased by 0.7 point from last year, and Nepal is ranked 27th out of 39 countries in the Asia-Pacific region.

3. What is the financial condition of Nepal?

Fiscal position of the Government of Nepal, based on banking transactions, remained at a deficit of Rs. 486.89 billion in 2022/23 compared to a deficit of Rs. 263.67 billion a year ago.

4. What are the three pillars of financial freedom?

saving, insurance, and investment are the three pillars

5. How is the Nepalese economy doing?

Nepal's real GDP growth accelerated to 3.9 percent in Fiscal Year2024, up from 2 percent in Fiscal Year 2023.

What's Your Reaction?