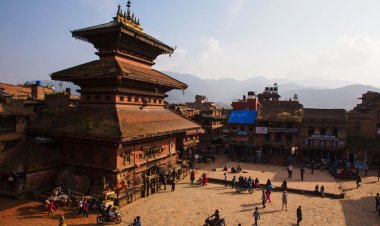

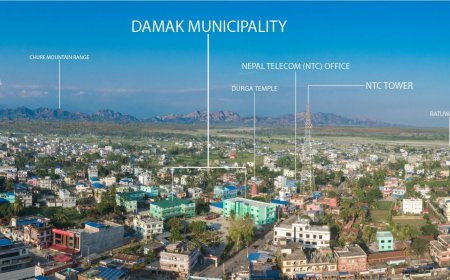

The Ultimate Guide to Exporting Products from Nepal - Featured Business and Trade Information

Get the ultimate guide to exporting products from Nepal, featuring essential information on business and trade. Discover everything you need to know to successfully export from this fascinating country.

Export of products from Nepal to various countries is governed by several laws and guidelines. Exporters must agree with these administrators and follow clear procedures. If any organization needs to start exporting or importing a business product from Nepal, it needs to run a legal business in Nepal. In addition, register for VAT. There is also a need for a customs department under the Ministry of Finance, which has also been able to collect customs duties and improve exchange aid. All exporters must obtain an Export and Import Code (EXIM Code) assigned by the Nepal Customs.

The export records required in Nepal depend on the trade policy of the Government of Nepal, the nature of goods exported from Nepal. The documents required for export from Nepal are also based on product export, multilateral, bilateral or unilateral trade agreements and other trade policies of the Government of Nepal. The point-by-point documentation on these export stages has been explained independently as follows.

In order to participate in exports, a company must be registered and obtain an export license. In case the exporter is a private or joint-stock company, the exporter applies to the company registration office to obtain a registration certificate. The exporter must obtain a business registration certificate for a sole proprietorship or partnership firm from the Ministry of Commerce under the Ministry of Commerce. The registered company must be selected by the local tax authority. The tax office evaluates the confirmation of inclusion every year. The registration certificate from the Permanent Account Number, also known as PAN, should be obtained from the Inland Revenue Office or the Department of Inland Income. This verification must be renewed annually during the first three months of each financial year. After that, a current bank account needs to be opened in a commercial bank in the name of the exporting company to carry out financial transactions related to exports. All financial transactions will take place via bank transfer. A separate foreign currency account is also needed for the exporter to receive payments in foreign currency. Registration for VAT (value added tax) is necessary. After the company is registered for VAT, the exporter gets the opportunity to refund the duty on the purchase of raw materials and intermediate products for the production of export goods. This means that the company will not have to pay additional tax for raw materials and equipment needed by the company, this duty refund will reduce the cost of export goods, which will strengthen business and increase competitiveness.

After completing the registration and documentation process, we now proceed to conclude the contract with the buyer. Buyers and sellers negotiate the product and price. When an understanding is reached between the exporter and the buyer, an export agreement can be signed between the two companies so that the importers send a purchase order that specifies the products, quantity, price, payment terms, packaging, delivery method and shipment date. When the purchase order is received from the importer, the exporter prepares a Proforma Invoice. A proforma invoice provides price information and other product details to enable the importer to open a letter of credit (L/C) in the name of the exporter. The bank takes over the guarantee for payment to the exporter as soon as the shipment is delivered to the importer. The dispatch of the shipment is ensured by a reliable freight company. Logistics can be done by air or freight. The air waybill will be given to the importer to track and receive the shipment. This is the stage when the product is ready and all the documents are cleared by customs. All documents should be provided by the exporter to the importer in order to receive the shipment from their customs authority. After that, the payment for the exporter can also be processed. These documents are the legal proof that the shipment has been delivered to the importer so that the bank can release the payment if the transaction was done in letter of credit as a payment method.

What's Your Reaction?