The History of Online Payment in Nepal - How Digital Transactions are Changing the Face of E-Commerce and Banking

Discover the history of online payments in Nepal and learn how digital transactions are changing the way we do business. Understand how the banking and finance sector is evolving in this country.

The online payment system plays a big role in increasing the efficiency of money circulation in the economy. A weak payment system not only lengthens payment periods and increases transaction costs, but also seriously threatens confidence in the entire financial system. So central banks exist all over the world. This is a significant and vulnerable settlement system, so it is important that it is efficient and trustworthy. There are banking systems that keep such important persons in check to protect people's trust in money as a medium of exchange. The Bank maintains financial stability and is critical to the effective and efficient functioning of the monetary framework. These facts led the Central Bank of Nepal to develop a payment system. The aim is to discuss the institutions that give the basic tasks for the development of the Nepalese payment system from a historical perspective. Online business payments, most importantly, these modern payment systems also rely on information and technology.

The beginning of payment systems began with the establishment of Nepal Rastra Bank as the central bank in 1956. The bank had direct control over all financial institutions in the country legally. However, until 1968, there were no specialized payment services, and banks functioned as an intermediary place with limited payment service to payees and payers of the same branch of the financial institution. Moreover, after the early 1970s, people in the country were encouraged to use checks in the banking system.

In general, in 1990, another touching milestone to bring up to the current online payment system was the introduction of digital payments. Commercial banks and some other financial institutions used the clearing center facilities. And until then, the branches of financial institutions were not divided with the core of the banking system. Thus, Nabil bank first introduced card banking in the economy by issuing a credit card in 1990. Other forms of digital banking followed, such as internet banking in 2002 by Kumari bank and SMS banking by Laxmi bank. in 2004. Himalayan Bank introduces the country's first ATM in 1995. Irrespective of the implications, Smart Choice Technology (SCT) was established in 2001 with the development of the SCT network across the country. A huge revelation in the payment system was full bank control and financial intuition along with the success of e-sewa in 2006.

After e-sewa payment system which is literally the evolved online payment system also the operation as a digital wallet in 2009 the customers could pay, send, and receive money via mobile phones and internet without having bank account.For the first time in the history of Nepalese payments system, the payments were executed without any involvement of financial institution. However, Nepal Clearing House Ltd.(NCHL) was established as a public limited company in late 2008. With the success of multiple payments cleaning and settlement strategies in Nepal, NCHL brought the big objectives, surprisingly in addition to electronic cheque cleaning services, and Interbank payments system form in 2016.

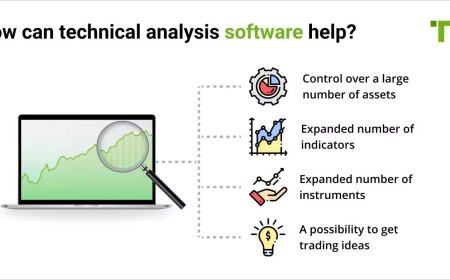

Likewise, use of digital mode payments, non-bank regulated mobile wallet along with the increasing global financial integration was on rapid expansion. Central Bank was forced to develop safe and efficient payment systems, and work on the modernization of payment system. It started a dedicated department for the regulations to carry out payment related activities and helped to develop online payments infrastructure in the country. Viewing account balance, recent transactions, bank statements, funds transfers between the customer’s linked accounts, payment to the third parties, including bill payments and third-party fund transfers are evolved similarly in Nepal as the development of international online banking and payment system.

What's Your Reaction?